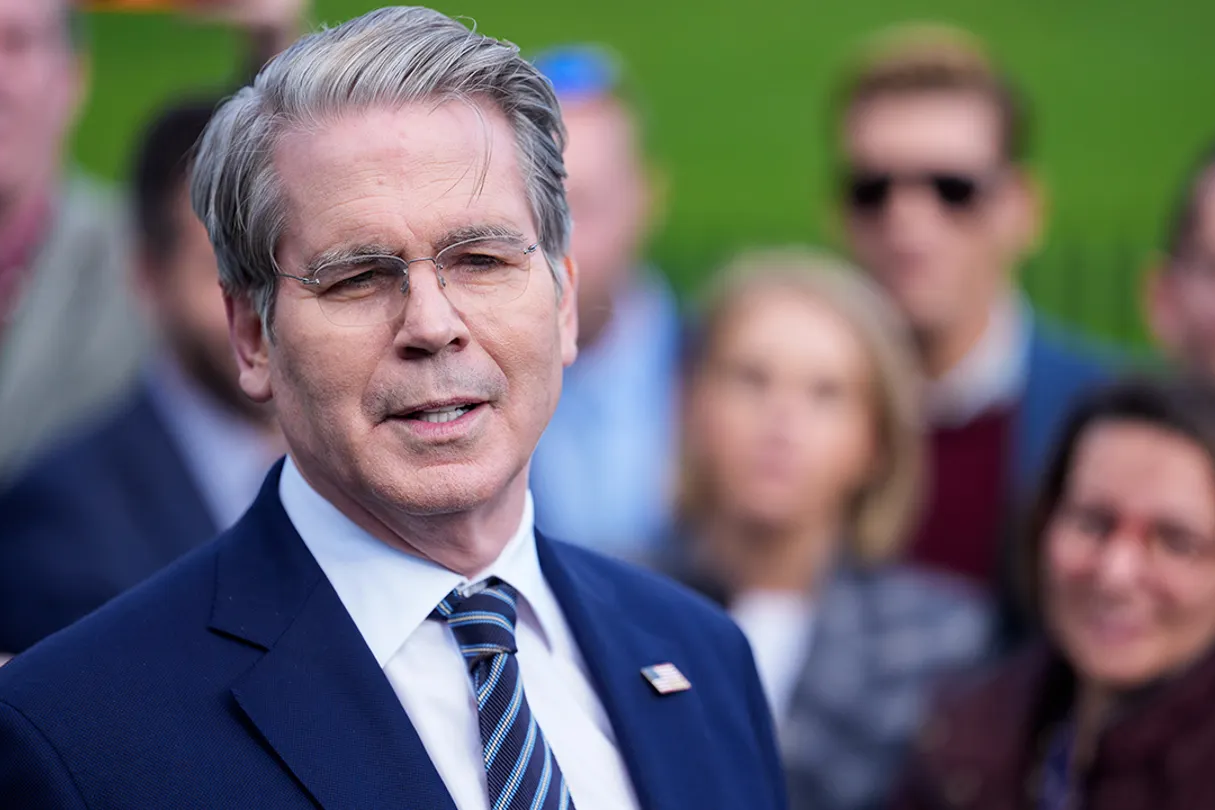

Former Federal Reserve Governor Kevin Warsh said the U.S. economy could grow tremendously, but "bad" policies by the Federal Reserve are keeping it from doing so. Warsh told "Kudlow" host Larry Kudlow that he had "some sympathy" for President Donald Trump being frustrated with how Federal Reserve Chair Jerome Powell and the central bank have been handling interest rates. "Economic growth in the U.S. is poised to boom, but it’s being held down by bad economic policies coming from the central bank, bad supervision policies, bad monetary policies, and a very confusing set of standards as we’ve gone from last year to this year," the former Federal Reserve governor said. Warsh told Kudlow that both interest rates and the Federal Reserve’s balance sheet should be lower than they are. FEDERAL RESERVE LEAVES KEY INTEREST RATE UNCHANGED FOR FOURTH STRAIGHT MEETING The range of the Federal Reserve’s benchmark interest rate is currently 4.25% to 4.5%. "We used to say that interest rate policy is housing policy, but we’re in a housing recession right now," Warsh argued. "First-time homebuyers are having a hard time getting a house. Thirty-year fixed-rate mortgages are closer to 7%." Cutting the Fed’s interest rates and bringing the yield curve down could position the economy for its "next degree of acceleration," according to Warsh.