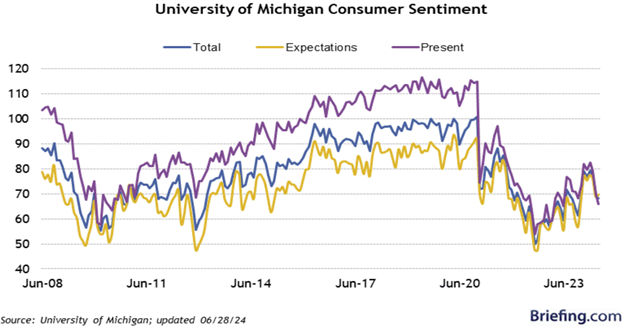

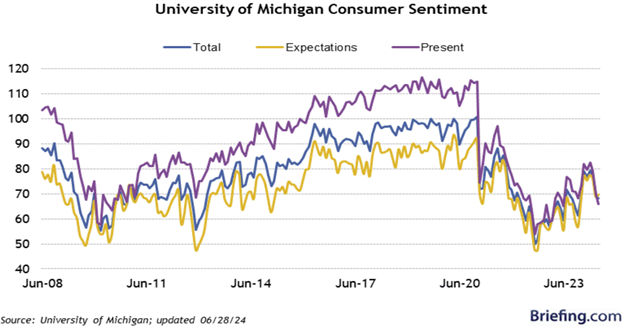

University of Michigan Consumer Sentiment for July hit 66.0…The consensus was 67.5, down from June’s final reading of 68.2. What does it mean – In the same period a year ago, the index stood at 71.5. Burdened by high interest rates, increasing regulation and inflation, consumers are feeling it at the cash register.

Consumers hitting the Credit Cards hard…Consumer credit increased by $11.3 bln in May. What does it mean – The consensus from Briefing.com and from others was $9.5 bln. This is after an upwardly revised number of $6.5 bln in April. Consumers racked up nearly $4.8 bln. or 73.84% more than in April. U.S. Government releases 1 million barrels or 42 million gallons of gasoline…Prior to the 4th of July holiday, the Biden administration authorized the government to release 42 million gallons in the northeast to lower gas prices prior to the holiday. What does it mean – This government loves picking winners and losers. Got to ask yourself why they would only release gas in the NE, specifically from reserves in New Jersey and Maryland that supply Pennsylvania, New York, Baltimore, Delaware, Connecticut, and New Jersey? Could it be good politics and would significantly affect the inflation numbers that came out this week? Not sure, but one thing is for sure, it temporarily lowered the cost to traveling, BBQing, and enjoying our Nations Birthday in the NE. First time home buyers are getting older…Due to rising interest rates, regulations, taxes, and inflation, home ownership is getting more and more difficult. What does it mean – Building is slowing and the costs of material, labor, and building regulations are increasing at the fastest rates seen in many years. California Dreaming!!

According to the Tenner Center for Innovation at UC Berkley, “Homeownership in California is increasingly out of reach relative to the country: in 2021 the share of adults who own their home in California was just 43.5 percent, more than 15 percentage points lower than the rest of the United States, which is the largest the gap has ever been. In California, the age at which more than half of residents are homeowners is 49; by comparison, across most of the United States that age is 35.” I guess if your children, family, and friends have already fled CA for the opportunity to chase their American dream, you can now understand why the average age of home ownership in most states is less than 30 and in CA it is now 49.